Martina Macpherson has extensively written on sustainable investing, banking and finance. She is an internationally recognised expert across industry and academia, and we are honoured that she accepted to contribute her views on where sustainable investment and finance stand. She also participates in our 28 June 2019 Public Value Summit.

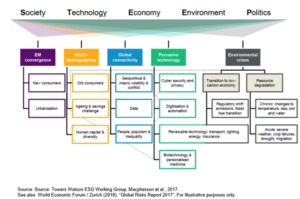

The interconnectedness of macro trends and ESG risks & opportunities

The world as we know it is undergoing multiple complex transitions and we are facing a broad range of macro-developments that are shaping the sustainable investment and finance landscape. These include:

- The long-term shift to a low-carbon economy and physical natural capital risks;

- Technological change of unprecedented depth and speed;

- A new global economic and geopolitical balance and the associated risk of division and polarisation;

- The corporate and investor focus on Sustainable Development Goals (SDGs) as a roadmap for (impact) assessments and reporting;

- A stronger institutional focus on long-term risks and opportunities that can affect economic, political and societal development and growth.

Managing these transitions and the deeply interconnected risks they entail requires long-term thinking, investment, and international cooperation, often at a public-private partnership level.

Given this complexity and the need for international and cross-border collaboration sustainable finance has become a key finance channel for considering environmental, social and governance (ESG) issues. It also encompasses an increasing awareness of and transparency on the risks which may have an impact on the sustainability of the financial system and calls for financial and corporate actors to mitigate those risks through appropriate governance.

The Sustainable Development Goals are leading the way

In 2015, landmark international agreements were established with the adoption of the UN 2030 Agenda and Sustainable Development Goals and the Paris Climate Agreement.

The Paris Agreement, in particular, includes the commitment to align financial flows with a pathway towards low-carbon and climate-resilient development. However, to achieve the EU’s 2030 targets agreed in Paris, including a 40% cut in greenhouse gas emissions, actors must still fill an investment gap estimated at 180 billion EUR per year.

The 17 U.N. Sustainable Developments Goals have become a de facto framework for bringing together market participants, companies, governments, and citizens with the aim of closing this financing gap, while protecting the planet, ending poverty, and promoting peace, prosperity, and global partnerships.

The goals are a roadmap for sustainability risks and opportunities and cover a range of environmental themes, such as climate and water risk, and social themes, such as equality, diversity and inclusion, health and wellbeing, education, human capital management, human rights, innovation and collaboration.

While (extra-)financial challenges for investors remain, there is a clear societal move towards a more mixed economy, in which the dividing line between private and public activities, as well as financial and non-financial gains, has become increasingly blurred. “Mixed economy” market participants include millennials and female investors. They can be categorised along three major dimensions:

- Values and beliefs (avoiding businesses involved in controversial activities);

- Impact (capturing measurable social returns); and

- Long-term horizon (mitigating / adapting against water scarcity, energy costs, or climate change).

Corporate actions and the role Millennials can play

Over the past decade, companies have also started to think more intentionally about how to maximise shareholder value by exploring the “mixed economy” interplay between financial, human and social returns, which, in turn, have demonstrated direct financial returns when it comes to gains in productivity, innovation and efficiency.

Support for social programmes has also accelerated economic growth and raised new income opportunities for global corporations, especially in the consumer-focussed sectors, creating a wider consumer base, supporting competitiveness and easing corporate entry into new markets.

Terms like ‘shared value’ and ‘triple bottom-line’ have hence become commonplace in board rooms around the globe. As a result, corporate social responsibility (CSR) is no longer conceived as a series of seemingly random feel-good grants, but as an essential tool that impacts a company’s philosophy and core business strategy including its brand value, market access and operations.

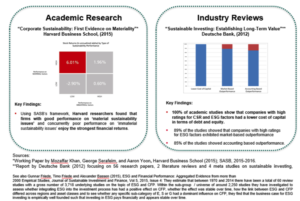

This development can be described as a move from corporate social responsibility towards an inclusive perspective on corporate social and financial performance. Academic research is supporting this and shows that companies that perform positively on “material sustainability issues” also enjoy the strongest financial returns.

Millennials, as investors and employees, are playing a key role in the “mixed economy” when it comes to “doing well by doing good”. They often aim to reflect personal values such as authenticity and integrity in their day to day decision making – at an advocacy, employee and increasingly at an investment level. In fact, multiple surveys have recently found that millennials are twice as likely as other investors to put their money into social or environmental investments. For them, it’s not enough to build up a personal fund: this generation is focused on making a better tomorrow. Affluent millennial investors are already taking action by investing in companies that support their ideals. These new fields of investment focus on companies that have a positive effect on the environment, society and technological growth.

Regulatory action and the EU Sustainable Finance Action Plan

The speed, scope and scale at which the sustainable finance market is developing relies on multiple variables, including market conditions, investor sentiment, financing trends policy and finally regulatory drivers. Over the course of the last few years, the sustainable finance landscape has experienced another fundamental change – with the shift from voluntary Codes and disclosure of ESG information towards mandatory, legal frameworks and reporting. This shift initially started at a country level, and has now reached a “supranational level”, especially when we look at the latest developments coming from the EU Commission.

With the help of the “Sustainable Finance Action Plan” the EU Commission intends to clarify how asset managers, insurance companies, and investment or insurance advisors should integrate sustainability risks and, where relevant, other sustainability factors in the areas of organisational requirements, operating conditions, risk management and target market assessment.

The EU’s “Sustainable Finance Action Plan” includes:

- A proposal for a regulation on the establishment of a framework to facilitate sustainable investment (“taxonomy”).

- A proposal for a regulation on disclosures relating to sustainable investments and sustainability risks.

- A new Green Bond standard.

- New benchmark regulation for the creation of low-carbon and positive carbon impact benchmarks, which will provide investors with better information on the carbon footprint of their investments.

EU Commission, Sustainable Finance Overview,

However, while the inclusion of and collaboration on sustainable finance issues is increasingly becoming a mainstream, regulatory topic, one stakeholder group must not be overlooked in the process: the next generation of young professionals, students and investors.

During the recent stakeholder dialogue meeting at the launch of the new sustainable finance taxonomy, the EU Commission made a clear call to bring the next generation of decision makers from the climate change protests to the policy decision making table. Inclusion of and engagement with the next generation of decision makers requires a deep understanding of the changing needs, challenges and habits of a generation that faces multiple environmental, social, economic, societal, technological and geopolitical issues.

At the Network for Sustainable Financial Markets we aim to provide a platform for the next generation for education, mentorship, career and talent management to engage with the next generation of students and young professionals and to establish and maintain more sustainable financial markets, over the long term.

For more information on the #NSFMNextGen initiatives, please visit https://www.nsfmnextgen.org, and to listen to SDG expert discussions, please visit the webinar channel on BrightTalk: